The beginning of a New Year is always a good time for prophecies and predictions. This is especially valuable if they are rooted in reality, based on actual data.

The healthcare advisory firm Sage Growth Partners published such a report, titled “Telehealth in 2023” which used data gathered from 95 health systems and 75 physician practices to make its predictions.

Key Findings

Here are the report’s four key findings along with my commentary:

1. No more expansion: only a fraction of organizations (11% of health systems and 8% of practices) are looking to expand their telehealth offerings.

It’s dismaying that the “key finding” focuses on the lack of “expansion” vs. highlighting that 20% of health systems (7% of practices) are “just getting started” and that 41% (35%) are looking to improve their existing practices, whereas a whopping 13% (15%) are still trying to figure it out. That means over a 3rd don’t really have a telehealth program yet.

- If you’re still trying to figure out the value of telehealth, read The CEO’s Handbook for Telehealth Success

- If you’re focusing on improving your program, read our nine articles on Optimizing Telehealth

- If you’re just getting started, get started with a Strategy and a Business Plan for your Telehealth Program.

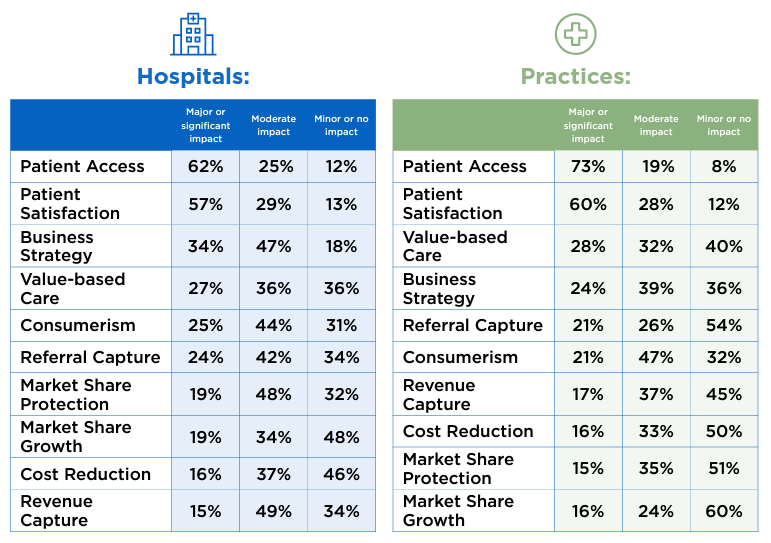

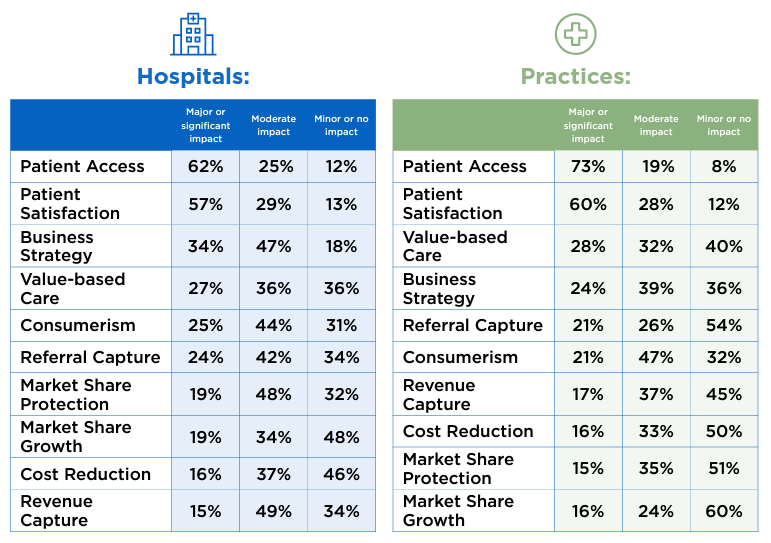

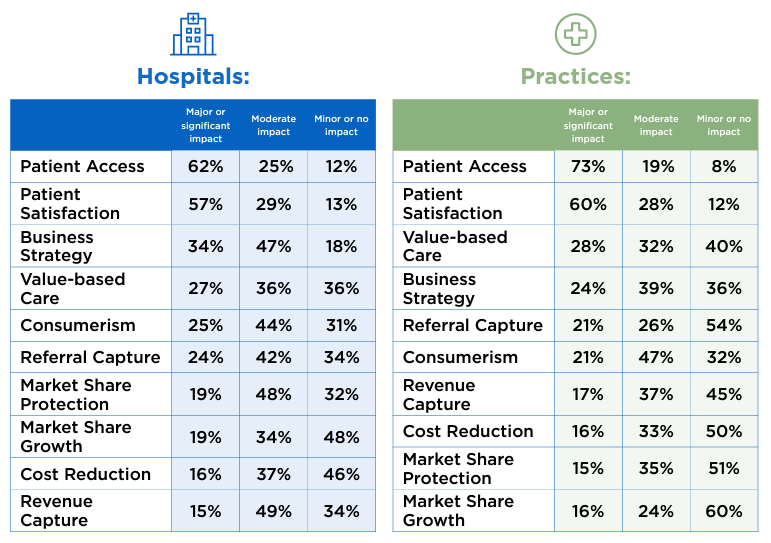

2. Top Benefits: the two top benefits named were enhanced patient access (62% & 73%) and increased patient satisfaction (57% & 60%).

While these two top places are not surprising, what is enlightening is the cumulative impact of the other benefits (see below), such as business strategy and value-based care. See the next section for more information on those.

3. Clinical Impact: About two-thirds of respondents indicated that Telehealth enables comprehensive quality care.

That key finding is wonderful to see in writing (almost vindicating) after decades of loud dismissal of the clinical value of telehealth (mostly by those not practicing telehealth at the time). The Covid-19 health crisis opened the telehealth flood gates and the eyes of many clinicians wary of telehealth. When implemented correctly, telehealth is treated as a clinical service, as a viable, integrated care delivery alternative to in-person care in a hybrid care delivery model. And when clinicians get to wield the telehealth tool, than clinical success is almost guaranteed.

4. Workflow: Over half of physician practices (52%) and over a third of hospitals (35%) indicated that telehealth increases the workload of support staff.

This “insight” is a mixed bag, especially on the hospital side, since the other 65% either don’t think it changed (38%) or that it actually decreased. On the physician practice side the difference is more pronounced. The point is valid, though: good telehealth is first and foremost an exercise in workflow design.

Did you know that you need to design 7 different workflows, from TeleScheduling to TeleBilling? Also, here’s a recipe for developing telehealth workflows.

from: Sage Growth Partners “Telehealth in 2023” report

Enhancing the Benefits of Telehealth

The second key finding of the report elicited a response on the following 10 benefits of telehealth, the majority of which were impacted by telehealth in a major, significant, or moderate way. The two percentages in parentheses list the hospitals and the practices cumulative response rate.

1. Patient Access (87% & 92%): No surprises here. Lack of transportation and lack of time are two of the most common barriers to access to care and telehealth swiftly addresses both of them. To increase these numbers even more, consider using a Telehealth TechCheck process to help patients with the most detrimental barrier: problems with technology.

2. Patient Satisfaction (76% & 88%): Again, no surprises here again. As from the Modern Healthcare Consumer’s perspective, the biggest dissatisfaction with healthcare is the inordinate (and disproportionate) amount of time a patient has to invest in a 7-minute visit. As patients become more savvy (and are expecting better quality telehealth visits), to enhance satisfaction, use the Telehealth TechChecks, invest in Webside Manners training for clinicians, and focus on optimizing the workflows for the physician and for the patient experience!

3. Business Strategy (81% & 63%): Hospitals are by nature more invested in thinking strategically vs. physician practices, which explains the large difference in these percentages. To enhance the value, consider systematically reviewing your current overall strategic objectives and identifying how telehealth can help move the needle into the right direction for each of your strategic objectives, so that telehealth creates strategic success.

4. Value-based care (63% & 60%): For decades, fee-for-service reimbursement has been the bane of telehealth’s existence. The future of care delivery asks not what you get paid for the patient interaction, but whether it helps to improve the patient’s health. My vision of great care is a combination of video visits, phone calls, secure messaging, at-home vital signs, driveway radiology, and kitchen table phlebotomy. It therefore behooves healthcare leaders to expand their telehealth program into more than just video visits, and to expand into all virtual care modalities.

5. Consumerism (69% & 68%): Since the term was not defined, I’ll just leave my advice on enhancing this metric to (1) truly understanding the needs of the Modern Healthcare Consumer and (2) working relentlessly on the patient experience by addressing patients’ telehealth pain points.

6. Referral Capture (66% & 47%): It’s great to see how leaders are beginning to understand the financial downstream value that telehealth can provide beyond the Covid-driven “keeping the doors open”. To increase this metric, an organization needs to expand its offerings to more specialties and more providers and improve the electronic referral process (including eConsults, i.e., clinician-to-specialist consultations).

7. Market Share Protection (67% & 50%): With many national, non-traditional competitors entering the healthcare space with a “virtual first” model, and many traditional providers also expanding their footprint nationally, protecting market share (especially for those “lucrative” fairly healthy, affluent patients) is increasingly important. Here again, word of mouth referrals from patients raving about a smooth, valuable telehealth experience will greatly enhance telehealth’s value for this metric.

8. Market Share Growth (53% & 40%): Many healthcare leaders are still mired in old thinking that looks at their service area geographically, because the assumption is fairly quickly the patient has to come in. Which, according to a December 2022 report by Epic Research, is not necessarily true. To leverage telehealth to grow your market share, the first challenge is a change in market definition: Which patients can our expertise serve best — vs. which patients are closest to us.

9. Cost Reduction (53% & 49%): The low percentage of this metric is in my opinion merely a lack of creativity and imagination. Especially in today’s difficult market with a nursing shortage, clinician burnout or lack of clinician engagement, telehealth can dramatically increase retention, reduce recruitment cost, and fill positions more quickly. On the quality side, telehealth can reduce or eliminate penalties,

10. Revenue capture (64% & 54%): Without a definition of this term in the report, I’m going to assume that this either refers to (a) the proper classification and coding of visits or (b) the collection of copays. To increase the value of telehealth for revenue capture, clearly define the coding and reimbursement processes for telehealth services and use a telehealth software (vs. your video conferencing solution or your EHR’s cobbled-together telehealth plug-in) that enables the pre-visit collection of copays.

Outlook for Telehealth in 2023

The future is bright for Telehealth in 2023 and there is so much more potential for growth and especially optimization. The Sage Growth Partners’ report is peppered with great insights and observations that I wholeheartedly agree with, such as:

- “It’s interesting to see that many C-suite executives said their hospitals are still figuring out or getting started with telehealth.”

- “Healthcare organizations that want to attract and retain patients must continue to offer and in some cases expand their telehealth services.”

- “Telehealth can help hospitals protect market share and compete with industry disruptors — but the survey findings indicate that many don’t recognize that.”

- “[M]ore organizations are recognizing that telehealth can be applied not only to ensure continuity of care but to enhance and optimize it.”

- “Hospitals and practices as well as telehealth technology and service providers need to take the workflow challenges seriously.”

Kudos to the Sage team for a well-designed survey, good analysis and spot-on insights!

If your organization would like to optimize, expand, or get started in telehealth, connect with me to explore how our vendor- and technology-agnostic telehealth advisory services have helped dozens of health systems, health centers, and behavioral health agencies over the past 15 years.

To receive articles like these in your Inbox every week, you can subscribe to Christian’s Telehealth Tuesday Newsletter.

Christian Milaster and his team optimize Telehealth Services for health systems and physician practices. Christian is the Founder and President of Ingenium Digital Health Advisors where he and his expert consortium partner with healthcare leaders to enable the delivery of extraordinary care.

Contact Christian by phone or text at 657-464-3648, via email, or video chat.